Future of Online CFD Trading: Key Trends and Insights for the Road Ahead

3 min read

The world of online CFD trading is evolving rapidly, driven by technological advances, regulatory changes, and shifting market dynamics. Staying updated on these trends is essential for traders who want to remain competitive. Here, we explore the emerging trends shaping the future of CFD trading and offer insights on how traders can adapt and succeed in this changing environment.

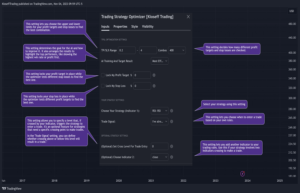

The Rise of AI and Machine Learning in Trading

One of the most transformative developments in CFD trading is the integration of artificial intelligence (AI) and machine learning. Modern trading platforms are now equipped with tools that simplify complex analyses, using AI to process vast amounts of data and uncover patterns that may not be immediately obvious. AI-driven algorithms assist traders by predicting market movements, enabling faster, more informed decisions. As AI technology continues to advance, it will likely become an even more integral tool for CFD traders, helping them make data-driven decisions with greater accuracy.

The Growth of Mobile Trading

Mobile trading is another trend that shows no sign of slowing down. With smartphones and tablets, traders are no longer tied to desktop setups. Mobile trading platforms now offer nearly the same functionality as desktop versions, allowing traders to monitor markets and execute trades on the go. The convenience of mobile trading means that traders can stay connected, respond to real-time events, and take advantage of opportunities as they emerge. As mobile trading technology continues to improve, it is expected to become even more central to CFD trading.

Increased Focus on Ethical and Sustainable Investing

The rise of ethical and sustainable investing is influencing online CFD trading as well. Many traders are now seeking opportunities that align with their social and environmental values. As a result, CFDs linked to companies with strong environmental, social, and governance (ESG) profiles are growing in popularity. This trend reflects a broader move toward responsible investing, where traders consider the societal and environmental impact of their trades alongside financial returns. For traders interested in sustainable strategies, ESG-focused assets are likely to become an important part of the CFD market.

Evolving Regulatory Landscape

Regulatory changes continue to play a significant role in the future of CFD trading. In recent years, there has been a global push for more transparency and stronger protections for retail traders, especially given the high-risk nature of leveraged instruments like CFDs. This trend toward tighter regulations may lead to stricter compliance requirements for both brokers and traders, with a focus on fair trading practices. Traders who stay informed about regulatory developments and adapt their practices will be better positioned to navigate the changing landscape.

The Growing Popularity of Cryptocurrency CFDs

As digital currencies gain wider acceptance, cryptocurrency CFDs have seen a surge in popularity. Many traders are now interested in speculating on the price movements of assets like Bitcoin and Ethereum without owning them directly. Cryptocurrency CFDs offer a way to engage with these volatile assets while benefiting from the flexibility and leverage that CFDs provide. As the cryptocurrency market continues to expand, demand for cryptocurrency CFDs is likely to grow, providing new opportunities for traders willing to explore this dynamic space.

Emphasis on Education and Skill Development

With financial markets becoming increasingly complex, there is a growing emphasis on trader education and skill development. Staying informed about market trends and continuously refining trading strategies are essential for success in online CFD trading. Many platforms now offer educational resources, including webinars, tutorials, and market insights, to help traders build knowledge and improve their performance. In an evolving market, traders who prioritize education will be better equipped to adapt and succeed.

Conclusion: Thriving in the Future of CFD Trading

The future of CFD trading is marked by rapid advancements in technology, the rise of mobile and cryptocurrency trading, an increased focus on ethical investing, and evolving regulations. To thrive in this fast-changing environment, traders should adopt a well-rounded approach that includes sound risk management, continuous learning, and adaptability. By balancing opportunities with careful risk control and leveraging the latest tools, traders can navigate the complexities of CFD trading and build a sustainable path to long-term success.