How to Optimize Your Trading Performance with Advanced Tools

4 min read

Trading in today’s markets requires more than just intuition and basic tools. To truly excel, professional traders need to harness the power of advanced trading tools. These tools can enhance performance, improve accuracy, and provide valuable insights that can drive trading success. In this article, we’ll explore how to leverage advanced tools to optimize your trading performance, offering practical insights and strategies to elevate your trading game.

Understanding Advanced Trading Tools

Advanced trading tools are designed to offer more sophisticated functionalities than standard trading software. They encompass a wide range of technologies and platforms that can provide a significant edge in the trading arena.

Advanced trading tools include algorithmic trading systems, high-frequency trading tools, artificial intelligence (AI) and machine learning (ML) applications, advanced charting software, and trade management systems. These tools are essential for traders looking to capitalize on complex market dynamics and execute trades with greater precision.

Compared to basic tools, advanced trading tools offer enhanced features such as real-time data analysis, automated trade execution, and predictive analytics. They can help traders make informed decisions faster and more accurately, which is crucial in a fast-paced trading environment.

Key Advanced Trading Tools and Their Features

Algorithmic trading systems use algorithms to automate trading decisions and execute trades based on predefined criteria. These systems can process vast amounts of data at lightning speed, allowing traders to capitalize on market opportunities that might be missed with manual trading.

Features and Advantages

- Speed: Algorithms can execute trades in milliseconds, much faster than a human trader.

- Accuracy: Automated systems reduce the risk of human error by following strict rules.

- Backtesting: Traders can test their strategies against historical data to evaluate their effectiveness before live trading.

Popular Platforms

Some widely recognized algorithmic trading platforms include MetaTrader 4 (MT4) and MetaTrader 5 (MT5), as well as more specialized platforms like TradeStation and AlgoTrader.

High-Frequency Trading (HFT) Tools

High-frequency trading involves executing a large number of trades in very short periods. HFT tools are designed to handle this volume of trades efficiently, using low-latency technologies to gain a competitive advantage.

Key Features

- Low Latency: Essential for executing trades within microseconds.

- Real-Time Data Processing: Continuous data analysis to make split-second trading decisions.

Considerations

Implementing HFT tools requires significant infrastructure and technological investment. It’s essential to ensure that your trading environment can support the high-speed data processing required for HFT.

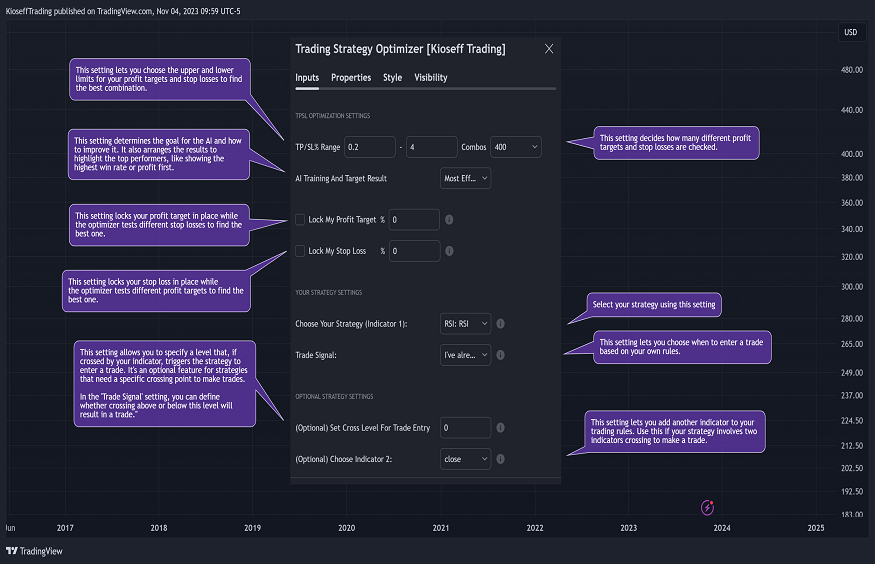

Advanced Charting and Technical Analysis Tools

Sophisticated charting tools provide enhanced features for analyzing market trends and making trading decisions. These tools offer more than just basic charts; they include customizable indicators, multiple timeframe analysis, and advanced chart types.

Key Features

- Customizable Indicators: Tailor indicators to match your trading strategy.

- Multi-Timeframe Analysis: Analyze price movements across different timeframes to identify trends and reversals.

Trade Management and Automation Systems

Trade management tools automate various aspects of trade execution and management, such as setting stop-loss and take-profit levels. These systems can help traders manage their trades more effectively and minimize the risk of emotional decision-making.

Benefits

- Automate routine tasks and trade execution.

- Set precise trade parameters to manage risk and maximize profits.

Popular Systems

Trade management tools are integrated into platforms like MetaTrader and cTrader, offering features like automated trade alerts and advanced order types.

Integrating Advanced Tools into Your Trading Strategy

Before integrating advanced tools, it’s crucial to evaluate your current trading strategy. Identify where these tools can add value, such as improving efficiency, enhancing analysis, or automating processes.

Selecting the Right Tools

Choosing the right tools involves evaluating several factors:

- Ensure that the tools are compatible with your existing trading setup.

- Select tools that offer features aligned with your trading goals.

- Consider the cost of the tools relative to their potential benefits.

Implementing Tools Effectively

Once you have selected the appropriate tools, integrate them into your trading workflow. This involves:

- Invest time in learning how to use the new tools effectively.

- Run simulations or paper trading to familiarize yourself with the tools before going live.

Measuring and Evaluating Performance

To assess the impact of advanced tools, establish clear performance metrics. These might include trade accuracy, execution speed, and overall profitability.

Evaluate how well the tools are enhancing your trading performance by analyzing the performance metrics. Adjust your strategy based on this analysis to optimize results.

Trading tools and technologies evolve rapidly. Stay updated with the latest advancements and continuously refine your use of advanced tools to maintain a competitive edge.

Common Pitfalls and How to Avoid Them

While advanced tools are powerful, it’s important not to rely on them exclusively. Combining these tools with fundamental analysis and personal judgment can lead to more balanced and informed trading decisions.

Integration challenges can arise, particularly with complex tools. Ensure that you have the technical support and resources to address any issues that may occur.

The trading technology landscape is constantly evolving. Regularly review and update your tools to stay current with the latest innovations and maintain optimal performance.

Conclusion

Advanced trading tools offer significant advantages for optimizing trading performance. By understanding and integrating these tools effectively, professional traders can enhance their strategies, make more informed decisions, and improve overall trading outcomes. Embrace the potential of advanced tools while maintaining a balanced approach that incorporates fundamental analysis and personal expertise. This holistic approach will help you achieve greater success in the dynamic world of trading.